Introduction

Do you know about the IRS? It has been working on a newly designed version of the Tax Form 1040 that will consolidate the former three forms into a simpler, shorter version of the original. It is a changeable tax format from the original 1040ez and 1040a forms and adds new supporting schedules. If you want to claim the standard deduction, this form of 1040 is perfect for you. For this reason, you don’t need to worry about new forms, schedules, or instructions that will be supplied automatically and filled out for you. There are some important methods to get the new IRS 1040 tax forms and instructions. This article is written for this topic.

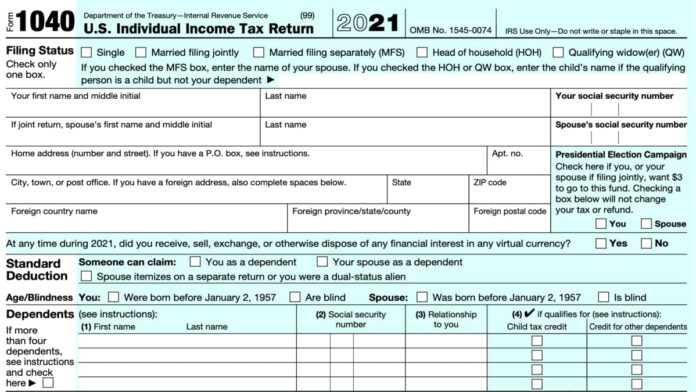

What Is The 1040 Tax Form?

As the 1040a tax form is a shorter version of the 1040 tax form, it can be used for taxpayers who have simpler tax returns. This tax form can be used to report income, deductions, credits, and taxes. If you can ready a file for the 1040a tax form, it is usually recommended that you do so because the 1040a tax form is shorter and easier to fill out than the 1040 tax form. For having a more complex tax return, you will need to use the 1040 tax form instead of the 1040a tax form. There are some examples of situations to file a 1040 tax form instead of a 1040a tax form. If you have self-employment income and own a business or rental property, you can get this form. By your capital gains or losses, you can receive unemployment benefits and interest income from taxable investments.

IRS 1040 Tax Forms & Instructions:

You will get these new forms & instructions if you can download the printable tax forms from the IRS tax forms page. As tax forms are supplied automatically by filing your taxes online. On the other hand, all post offices and neighborhood libraries have tax forms and instructions available throughout tax season. You can collect it from a tax center or an IRS office. There is another good way to get this form, you can ask for a tax form to be delivered to you from the IRS by U.S. Mail. These methods are very easy and friendly to control. The new RIS form takes more time to fill out and it rewards taxpayers by offering them extra possibilities. Then they can reduce their income tax bills easily. So, tax form 1040 & instructions are very important to maintain.

Then you should aware of the different kinds of IRS form 1040 and the instructions that are the best to know about income tax forms. It suits your specific circumstance and lets you declare the earnings, deductions, credits, etc. It can relate to you very much. You will get many types of this form, such as IRS Tax Form 1040, The Long Form or Form 1040, The Short Form or Form 1040A, Form 1040EZ, Form 1040NR, and Form 1040NR-EZ as well. We know that form 1040 is the usual federal income tax form widely. To get more information, you should take help from filemytaxesonline.org.

Conclusion

In the last step of this article, we can say that the RIS tax form is the best option for you. It needs to file a 1040 tax form and get benefits from this form. So, you should know more about this tax form than click filemytaxesonline.org site.